vermont state tax rate

Vermont has a number of sales tax exemptions that should limit the amount of sales taxes paid by most seniors. Use this section to elect a withholding rate not listed on page 1.

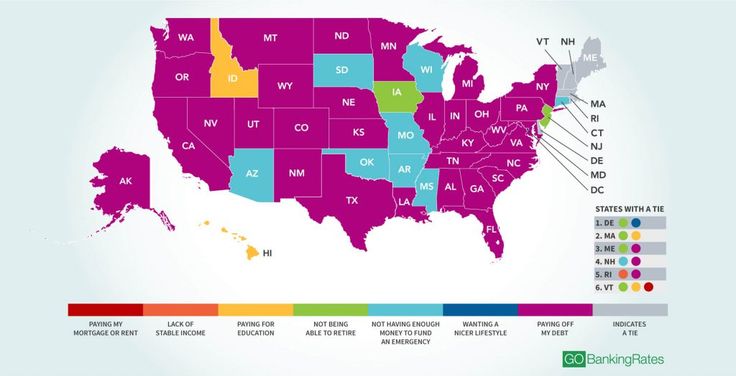

The No 1 Cause Of Financial Stress In Every State

What is the SUI Tax Rate.

. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. The average effective property tax rate in Caledonia County is 196 compared to Vermonts 186 average. IN-111 Vermont Income Tax Return.

Some cities including Burlington and Dover collect an additional sales tax of 1. 2021 the states flat income tax rate was reduced to 499 percent on January 1 2022. Understand and comply with their state tax obligations.

State lawmakers have instead prioritized income tax cuts which yield more economic benefit reducing individual or corporate income tax rates or both in two dozen states in the. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Beginning July 1 2004 the new employer rate for most employers is one percent 1.

I file a tax return in Name of state Check and complete one box below Withhold Withhold Do not withhold. This includes interest taxed at the federal level but exempted for Vermont income tax purposes and interest not taxed at the federal level. IN-111 Vermont Income Tax Return.

2022 Alabama State Tax Rate Schedule published by the Alabama Department of Revenue. File or Pay Online. I have read and understand the applicable State Income Tax Withholding Rules on this form and agree to abide by those rules and conditions.

VERMONT 6 VIRGINIA 53 2 25 2. Update on 2022 Employer Rate Notices. Before sharing sensitive information make sure youre on a state government site.

PA-1 Special Power of Attorney. Vermont has 19 special sales tax jurisdictions. Alabama income tax forms are generally published at the end of.

It is worth noting however that rates in nearby New Hampshire are even higher. The tax rate in most areas is 6. Most states set a corporate tax rate in addition to the federal rate.

For individuals employers and others looking for information about unemployment insurance resources in Vermont please review the links below or contact the UI Division for more information. Car Truck Trailer and Motorcycle Titles. Employers pay unemployment taxes at a New Employer rate until such time as they earn a rate based on their experience with unemployment.

South Carolina Tax Brackets 2022 - 2023. Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects individual income taxes similarly for Single versus Married filing statuses for example. PA-1 Special Power of Attorney.

Certificate of Title New - 3500 Certificate of Title Replacement - 3500 Certificate of Title Corrected - 3500 Lien each - 1100 Title Search - 2200 ATV Motorboat and Snowmobile Titles. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. Following the 2020 presidential election 991 of Vermonters lived in one of the states 13 Solid Democratic counties which voted for the Democratic presidential candidate in every election from 2012 to 2020 and 09 lived Essex County the states one Trending Republican county.

SUI tax rates are part of the payroll taxes you are responsible for paying as a small business ownerSUI which stands for State Unemployment Insurance is an employer-funded tax that offers short-term benefits to employees who lost their jobs through a layoff or a firing that is not misconduct related. The following states do not have a state corporate tax rate. The state tax is payable on the first 15500 in wages paid to each employee during a calendar year.

Updated Weekly Benefit Amount Notices to Claimants. State government websites often end in gov or mil. But not all states levy a corporation tax rate.

We can also see the progressive nature of South Carolina state income tax rates from the lowest SC tax rate. W-4VT Employees Withholding Allowance Certificate. Line f HOUSEHOLD INCOME - Interest on US state or municipal obligations Enter the income reported on federal Form 1040 and all interest income from federal state or municipal government bonds.

New Mexicos rate reduction is the first state sales tax rate cut in five years since Louisianas state rate declined from 50 to 445 percent on July 1 2018. This eastern Vermont County has property tax rates above the state average. Vermont School District Codes.

W-4VT Employees Withholding Allowance Certificate. 2 Includes statewide 10 tax levied by local governments in Virginia. Overall the average sales tax rate in Vermont is 624.

Some state tax food but allow a rebate or income tax credit to compensate poor households. 2021 Vermont Rate Schedules and Tables. HI ID KS OK and SD.

State corporate income tax rates range from 0 999. Overall Vermont was Solid Democratic having voted for Barack Obama D. This is the first of six incremental reductions that will ultimately reduce the rate to 399 percent by tax year 2027.

Please reference the Alabama tax forms and instructions booklet published by the Alabama Department of Revenue to determine if you owe state income tax or are due a state income tax refund. How to Complete a Fillable PDF. FY2023 Property Tax Rates.

3 Tax rate may be adjusted annually according to a formula based on balances in the.

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Map Usa Map

Usa State Taxes 2017 950 5b Usa Veterans Volunteer Services Veteran Owned Business

States That Tax Six Figure Incomes At A Higher Rate Accidental Fire

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

This Map Shows Where The Most Debt Burdened People In America Live Student Loans Map Debt

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Retirement Locations

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Community

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Vermont Named 1 Least Tax Friendly State For Retirees Vermont Business Magazine Retirement Retirement Locations Retirement Advice

Location Matters Effective Tax Rates On Corporate Headquarters By State Freedom Day Freedom Tax Day

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

U S Time Zone Gerrymandering Infographic Map Time Zones World Geography

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Best Places To Move

Indigenous American Population As A Percentage By County 950x765 Amazing Maps Map Native American Population